Is Underpinning Bad for House Value

Your property needs underpinning or already has it. Now you’re concerned about how this affects value. Whether you’re in Preston, Lancaster, or anywhere across Lancashire, understanding underpinning’s impact on property values helps you make informed decisions and set realistic expectations.

Underpinning does affect value, but not always as negatively as feared.

Initial Value Impact

Properties requiring underpinning lose 5-15% value typically. This reflects buyer concerns about subsidence history, insurance difficulties, and future saleability challenges.

Severe recent subsidence causes maximum devaluation. Movement within the last 2-3 years creates greatest buyer resistance. Expect discounts toward the higher end of ranges.

Historic underpinning from decades ago impacts value less. Subsidence from the 1980s or earlier that hasn’t recurred creates minimal concern. Buyers recognise the problem has been resolved long-term.

Underpinning vs Non-Underpinned Subsidence

Properties with completed underpinning sell better than those with untreated subsidence. Professional repairs demonstrate problems have been addressed. Unrepaired subsidence creates maximum uncertainty and resistance.

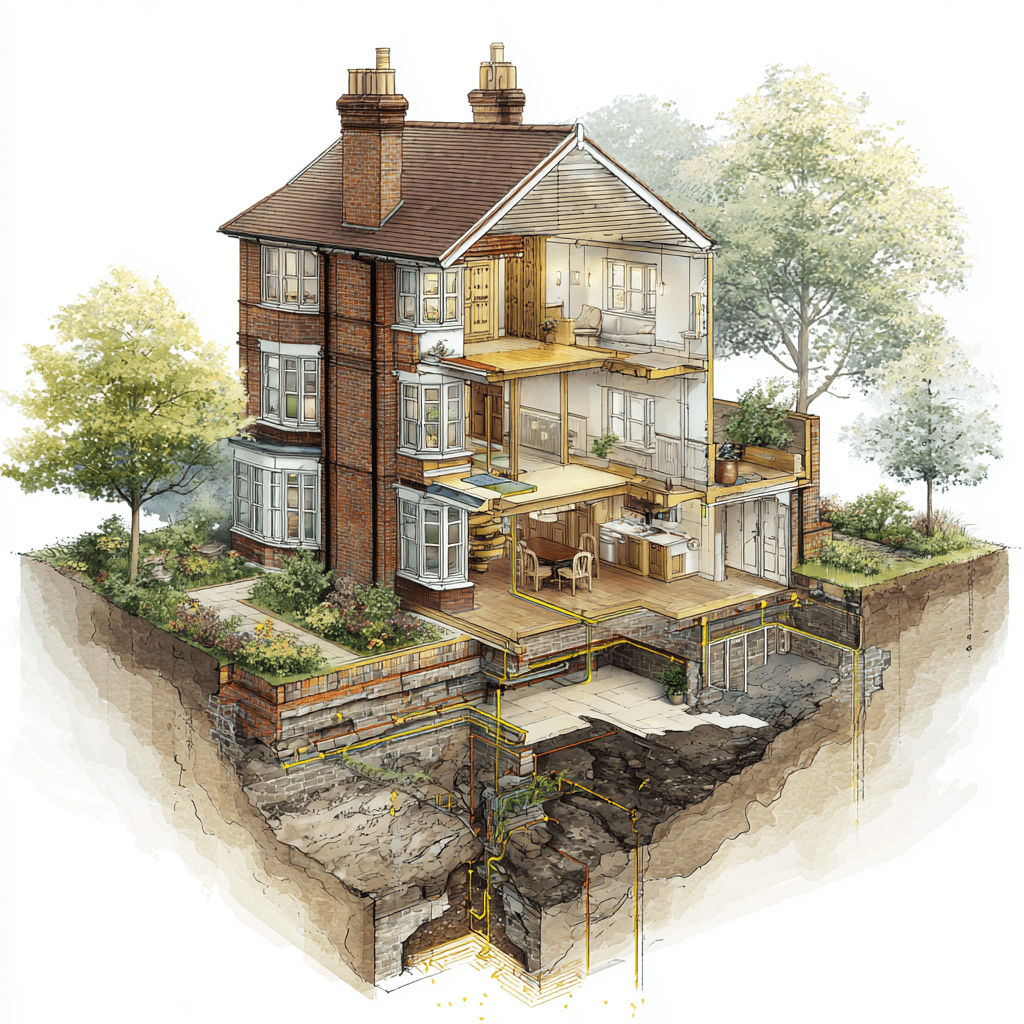

Quality underpinning can add technical value. Foundations now extend deeper than original construction. On Lancashire clay, modern underpinning to 2.5-3 metres exceeds Victorian foundations at 600-900mm. This represents genuine improvement.

Transferred warranties reassure buyers. 25-year guarantees covering future owners reduce perceived risk. Properties with substantial transferable warranties maintain value better than those without.

Documentation Quality Matters

Comprehensive repair records minimise value loss. Engineering reports, contractor warranties, building control certificates, and monitoring records demonstrate professional treatment. This documentation reassures buyers and mortgage lenders.

Missing documentation compounds value loss. Properties showing evidence of historical underpinning without proper records create maximum uncertainty. Buyers can’t verify work quality or whether problems might recur.

Insurance Challenges Affect Value

Properties with subsidence history face insurance difficulties. Many insurers refuse coverage. Others charge premium rates or exclude future subsidence claims. These insurance challenges depress values significantly.

Available insurance reduces impact. If you’ve secured comprehensive coverage including subsidence, providing proof helps buyers understand they can obtain insurance too. This demonstration significantly reduces value impact.

Uninsurable properties suffer maximum devaluation. Properties that absolutely no insurer will cover face 15-25% value reductions. Most buyers need mortgages requiring insurance.

Mortgage Lender Perspectives

Some lenders refuse mortgages on underpinned properties. This immediately restricts buyer pools. Properties only accessible to cash buyers or select lenders lose substantial value.

Lenders accepting underpinned properties might require larger deposits. If lenders insist on 20-25% deposits rather than standard 10%, buyer pools shrink. Fewer qualified buyers means lower prices.

Lender-approved documentation is essential. Engineering reports from recognised firms satisfy lenders better than unknown contractors’ paperwork. Quality documentation minimises mortgage restrictions.

Lancashire-Specific Considerations

Clay soil properties throughout Preston and Blackburn commonly show subsidence. Buyers in these areas sometimes accept underpinning more readily than in areas where subsidence is rare. Familiarity reduces panic.

Victorian terraces across Lancaster, Burnley, and other Lancashire towns often need underpinning. Buyers targeting these properties might recognise underpinning as addressing inherent foundation inadequacy. This contextual understanding reduces stigma.

Former industrial sites around Lancashire often have ground issues. Buyers purchasing in these areas might expect foundation complications. Properties with professional underpinning might actually reassure them compared to untreated properties.

Quality of Repairs Influences Impact

Traditional mass concrete underpinning receives widest acceptance. This proven 150-year-old technique reassures conservative buyers and lenders. Properties underpinned using traditional methods maintain value best.

Resin injection acceptance is growing. Modern buyers and lenders increasingly recognise this technique’s legitimacy. However, some conservative buyers still prefer traditional methods. This slight resistance marginally affects values.

Mini-piled underpinning falls between traditional and resin in acceptance. Recognised as legitimate but less familiar than traditional methods. Value impact sits between the two extremes.

Time Heals Stigma

Value impact diminishes over time. Underpinning from 5 years ago creates more concern than work from 20 years ago. Annual reduction in stigma typically reaches 5-10% of initial impact.

Decade-old underpinning with no recurrence proves stability. After 10+ years without further movement, buyers recognise the repair succeeded. Value impact reduces to perhaps 2-5% from initial 10-15%.

Very old underpinning becomes historical curiosity. Properties underpinned in the 1950s-1970s face minimal stigma if no recurrence occurred. The successful decades-long track record overrides concerns.

Preventing Further Value Loss

Don’t undertake poor-quality repairs. Cheap inadequate underpinning creates maximum long-term value loss. The work fails, problems recur, and values plummet further. Quality repairs prevent this deterioration.

Maintain comprehensive records. Keep every engineering report, contractor invoice, building control certificate, and monitoring log. Future buyers need this evidence.

Obtain substantial warranties. Insist on minimum 10-year guarantees, preferably 25 years. Transferable warranties protect future values.

Address underlying causes. Underpinning foundations whilst ignoring leaking drains or problem trees invites recurrence. Comprehensive solutions maintain values better than symptomatic repairs.

Comparable Property Analysis

Research local comparable sales. Check Land Registry records for nearby underpinned properties. Actual sale prices reveal market reality better than speculation.

Ask estate agents about local market attitudes. Lancashire agents with subsidence experience understand how local buyers respond. Their market knowledge guides realistic pricing.

Consider neighbourhood context. In areas where 20% of properties show subsidence history, your property faces less stigma than being the only affected house on a street.

Positioning Properties for Sale

Price realistically from the start. Overpricing underpinned properties leads to prolonged marketing that worsens stigma. Competitive initial pricing attracts buyers quickly.

Emphasise improvements. Market the deeper foundations as quality enhancement. Stress warranties and monitoring proving stability.

Target appropriate buyers. Cash buyers, investors, or those specifically comfortable with subsidence prove more receptive than first-time buyers seeking perfection.

Disclose proactively. Honesty in listings avoids wasting time with buyers who’ll reject properties upon discovering subsidence history.

Professional Valuations

Commission RICS surveys specifically addressing underpinning. Professional valuations account for subsidence history whilst recognising quality repairs. These valuations guide realistic pricing.

Desktop valuations underestimate underpinned properties. Automated valuation models don’t properly account for subsidence nuances. Physical surveys by qualified surveyors provide accurate assessments.

Regional Market Variations

Strong markets absorb subsidence stigma better. During property booms, buyers overlook issues they’d reject in weak markets. Selling during upturns minimises value loss.

Weak markets compound subsidence impact. Properties that might lose 10% in strong markets lose 15-20% in downturns. Timing sales for market strength helps.

Premium Property Impacts

High-value properties suffer proportionally. £500,000 properties losing 10% represent £50,000 losses. The absolute amounts become substantial.

Character properties might suffer less. Victorian or Georgian properties with architectural merit sometimes maintain values better. The character compensates partly for subsidence history.

New Build Underpinning

New builds requiring underpinning within warranty periods face maximum stigma. These represent clear construction failures. Value losses reach 15-25%.

NHBC remedial work documentation helps. If underpinning occurred under warranty with NHBC oversight, proper documentation reduces buyer concerns somewhat.

Investment Property Considerations

Rental yields matter more than capital values for investors. Properties generating strong yields despite subsidence history attract investor buyers even if private buyers reject them.

Tenant perceptions differ from buyer perceptions. Tenants care less about subsidence history than buyers making 25-year commitments. Rental markets prove more forgiving.

Maximising Value Despite Underpinning

Maintain properties immaculately. Perfect decorative condition partly offsets subsidence concerns. Buyers see properties that have been loved and maintained.

Update where possible. Modern kitchens, bathrooms, and energy efficiency improvements add value offsetting subsidence discounts partially.

Emphasise location advantages. If your property benefits from excellent location, good schools, or transport links, these positives balance subsidence negatives.

Offer inducements. Contributing toward buyers’ legal fees or including fixtures and fittings sometimes seals deals that might otherwise fail.

Legal Protections

Comprehensive disclosure protects you legally. Honest full disclosure on TA6 forms prevents future misrepresentation claims.

Keep evidence of disclosure. Retain copies of completed forms and communications where you disclosed underpinning. This evidence defends against later claims you concealed information.

Long-Term Value Recovery

Markets adjust over time. As more properties experience subsidence, stigma gradually reduces. What shocked buyers in the 1980s creates less concern now.

Technical understanding improves. Modern buyers better understand subsidence represents manageable issues rather than catastrophic defects. This education gradually reduces value impacts.

Climate change increases subsidence frequency. As more properties experience clay-related subsidence, the relative stigma of affected properties reduces. This normalisation benefits values long-term.

Accepting Reality

Some value loss proves unavoidable. Properties with subsidence history won’t achieve prices identical to never-affected comparable properties. Accepting this reality helps set appropriate expectations.

Focus on absolute values rather than losses. If your property sells for £200,000 rather than £220,000, you’ve still achieved a substantial sale. The £20,000 reduction stings but shouldn’t obscure the £200,000 gained.

Consider whether selling is necessary. If subsidence value loss would be substantial, continuing to live in your property or renting it out might make more financial sense than selling immediately.

Life goes on after subsidence. Whilst underpinning affects values, it doesn’t destroy them. Thousands of families happily occupy underpinned properties throughout Lancashire. These homes remain valuable, functional, and saleable despite their histories.